I. What are the “two warehouses”?

1. Definition

The “two warehouses" collectively refer to Bonded Warehouses and Export Supervised Warehouses.

2. Bonded Warehouse

A bonded warehouse is a facility approved by customs for the exclusive storage of bonded goods and other goods for which customs formalities have not yet been completed.

3. Export Supervised Warehouse

An export supervised warehouse is a facility approved by customs for storing goods that have completed customs export formalities, carrying out bonded logistics distribution, and offering circulation-oriented value-added services.

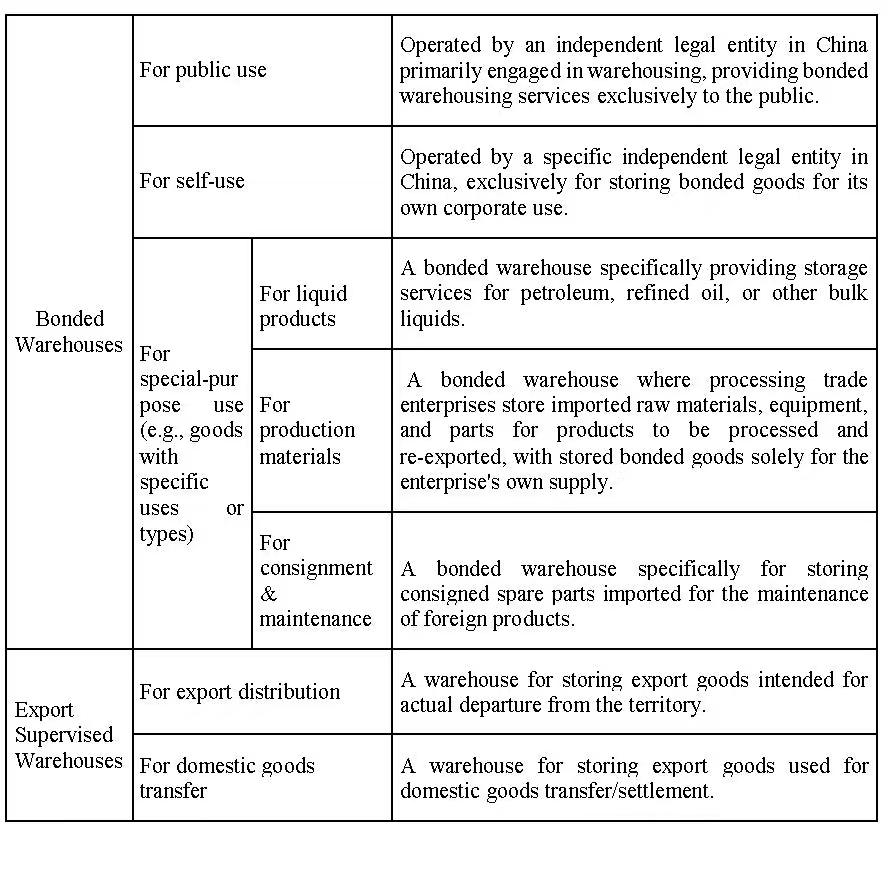

4. Types

II. What are the functional roles of the “two warehouses”?

(i) Bonded Warehouse

Bonded warehouses serve multiple purposes, including bonded storage, basic processing, allocation and delivery, and international transit trade.

1. Bonded Storage: Upon imported goods entering a bonded warehouse, they can temporarily be exempt from import duties and import-stage taxes. In normal cases, the submission of relevant permits can also be temporarily waived. The payment of taxes and submission of permits are only required when the goods are formally imported into domestic market, which helps ease the one-time tax burden on businesses and increases trade flexibility.

2. Simple Processing: Goods stored in bonded warehouses can undergo simple processing such as packing, grading and sorting, remarking, splitting, and assembling. However, substantial processing is not allowed.

3. Allocation and Delivery: Goods in bonded warehouses can circulate in a bonded state between special customs supervision areas and bonded logistics centers, assisting companies in establishing distribution centers for both international and domestic markets. Specifically, goods can be either transferred for export or promptly delivered to the domestic market for production or consumption through processing trade or general trade, ensuring timely supply.

4. International Transit Trade: Enterprises can also use bonded warehouses for international transit operations. After imported goods enter a bonded warehouse, they can be re-exported to neighboring countries or regions when an opportune moment arises.

(ii) Export Supervised Warehouse

Export Supervised Warehouses offer functions such as export tax rebates, domestic transfers, and circulation-oriented value-added services.

1. Export Tax Rates: Generally, goods entering an export supervised warehouse are not eligible for a tax rebate until they have actually left the country, at which point the state tax authorities processes the refund. However, For warehouses qualifying for “in-warehouse tax rebate” policy, the tax rebate can be processed as soon as the goods are stored.

2. Domestic Transfers: Typically, processing trade goods are exported to the warehouse, then return to the domestic market through import declaration procedures (either as general trade or processing trade). This addresses multiple market needs, including processing trade verification and write-off, transfer of goods ownership for multi-party sales, and conversion of trade modes.

3. Circulation-Oriented Value-Added Services: Goods stored in export supervised warehouses must not undergo substantial processing. Nevertheless, with the approval of the competent customs authority, permitted services include quality inspection, grading and sorting, picking and packing, remarking, labeling, shrink-wrapping, and re-packaging.

Disclaimer:The above content is translated from Chinese version of Huangpu Customs 12360. The Huangpu Customs 12360 version shall prevail.

Hot News