To bolster the success of the China Import and Export Fair (hereinafter referred to as the Canton Fair), and with approval from the State Council, the Ministry of Finance, in collaboration with the General Administration of Customs and the State Taxation Administration, issued the Notice on the Continued Implementation ofPreferential Tax Policies for Imported Exhibits Sold During the Exhibition Period at China Import and Export Fair in 2024.

The 138th Canton Fair will take place in Guangzhou from October 15 to November 4, organized across three phases. How can exhibitors maximize these tax benefits? Let’s explore the key details.

I. Policy Basis

(I) Notice by the Ministry of Finance, the General Administration of Customs, and the State Taxation Administration on the Continued Implementation of Preferential Tax Policies for Imported Exhibits Sold During the Exhibition Period at China Import and Export Fair(Cai Guan Shui [2024] No. 10).

(II) Notice by the Ministry of Finance, the General Administration of Customs, and the State Taxation Administration on the Preferential Tax Policies for Imported Exhibits Sold During the Exhibition Period at China Import and Export Fair (Cai Guan Shui [2023] No. 5).

II. Policy Details

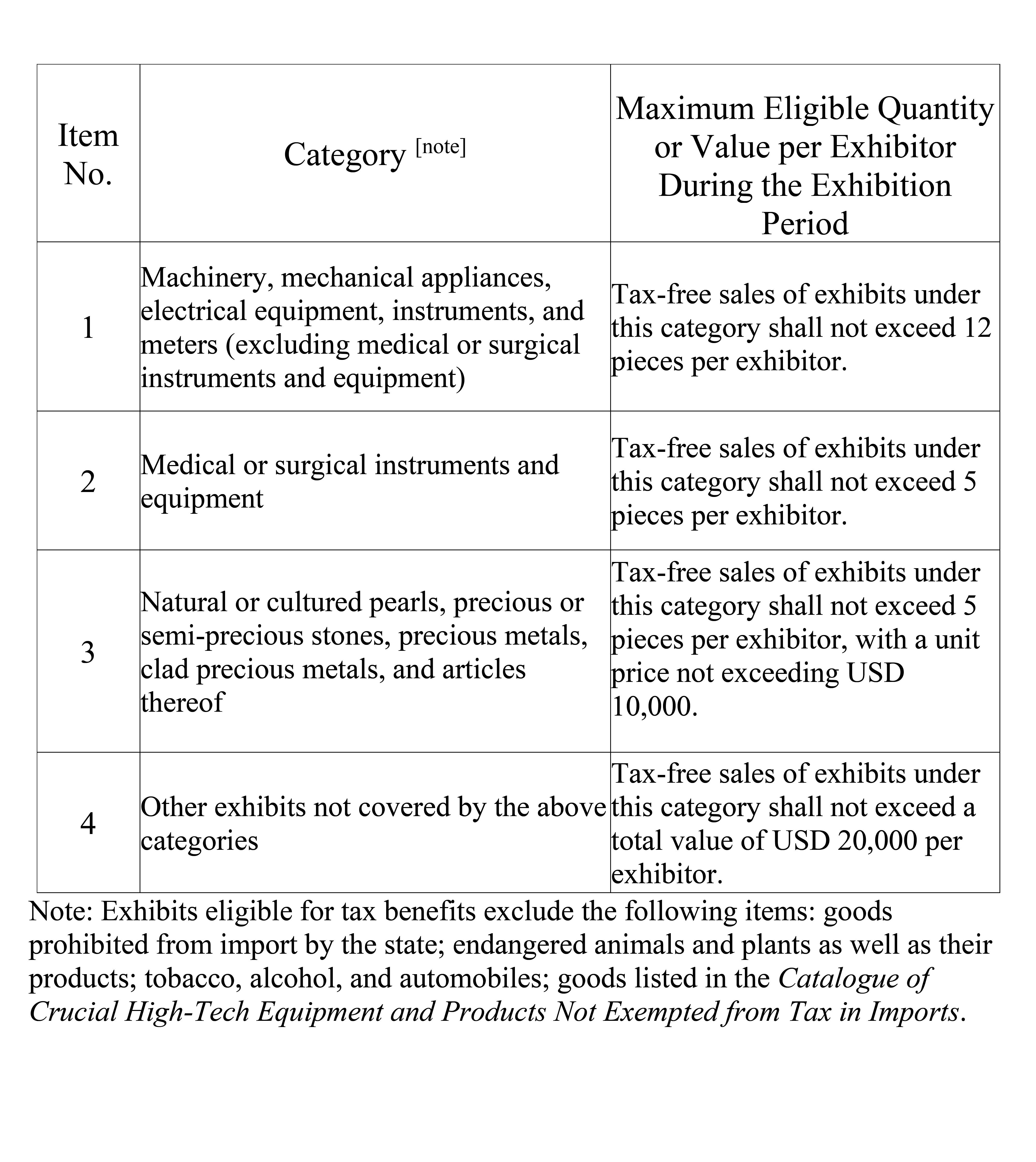

(I) Imported exhibits sold within the approved tax-free quota during the Canton Fair period, as designated by the Ministry of Commerce, are exempt from import tariff, import VAT, and consumption tax. Each exhibitor's cumulative tax benefits - in terms of exhibit categories, sales quantities, or value limits - during the current year's exhibition period shall be implemented in accordance with relevant regulations.

(II) Exhibits eligible for tax benefits exclude the following items: goods prohibited from import by the state; endangered animals and plants as well as their products; tobacco, alcohol, and automobiles; goods listed in the Catalogue of Crucial High-Tech Equipment and Products Not Exempted from Tax in Imports.

(III) For any exhibits sold by an exhibitor during the exhibition period that exceed the eligible categories or sales quotas under the preferential tax policies, as well as exhibits that remain unsold during the exhibition period and are not re-exported after the exhibition ends, taxes shall be levied in accordance with relevant state regulations.

(IV) The list of exhibitors and the list of imported exhibits sold during the exhibition period shall be uniformly submitted to Guangzhou Customs by the organizer, namely China Foreign Trade Centre or China Foreign Trade Centre Group, Ltd.

(V) For imported exhibits sold during the exhibition period that enjoy this policy, Customs will no longer apply subsequent supervision as specific tax-free goods.

III. Tax-Free Quotas

IV. Eligibility Criteria

(I) Enterprises applying for preferential treatment must be official import exhibitors at the current session of the Canton Fair, satisfy all eligibility requirements for participation in the Canton Fair Import Exhibition, and have successfully obtained an exhibition booth.

(II) Exhibits declared for preferential treatment must fall within the scope of products eligible for the Canton Fair Import Exhibition and have completed all required Customs declaration procedures for entry. To avoid failure to secure preferential treatment resulting from delays in completing domestic sale formalities - a situation likely to arise when applying for necessary import qualifications on an ad-hoc basis during the exhibition period - it is strongly recommended that enterprises secure all required import qualifications for eligible exhibits of tax preferential policies in advance, including but not limited toCCC certification, animal and plant inspection and quarantine approvals, and medical device import filing or registration.

V. Application Procedure

(I) Canton Fair import exhibitors shall submit an application to the China Foreign Trade Centre for the sale of imported exhibits during the exhibition period.

Materialslisted below must be provided by exhibitors applying for preferential policy benefits:

1. Supporting documents such as the temporary entry Customs declaration form for the relevant exhibits;

2. A catalogue or list of imported exhibits sold by the relevant exhibitor during the exhibition period;

3. Relevant supporting documents of the exhibitor;

4. Materials such as sales contracts, invoices, packing lists, and product descriptions;

5. Other documents or materials deemed necessary by the organizerof Canton Fair.

(II) After review, the China Foreign Trade Centre shall issue the Confirmation List for Exhibits Eligible for Tax Preference at the China Import and Export Fair (Canton Fair) (hereinafter referred to as the Confirmation List).

(III) The China Foreign Trade Centre or its designated entity shall, holding the Confirmation List and relevant Customs declaration documents, submit a unified declaration to Guangzhou Customs. The categories, sales quantities, or value limits of exhibits eligible for tax preferential policies shall be implemented in accordance with regulations.