Guidelines for the Declaration of Imported Acrylic Fibers

Issue Date:2025-05-12 Source:Tianjin Customs 12360

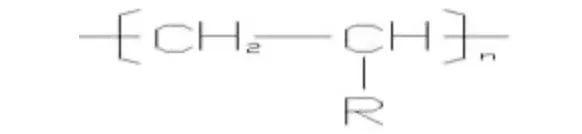

Acrylic fiber, also referred to as polyacrylonitrile fiber, is known in English as Polyacrylonitrile Fiber or Acrylic Fiber. Its chemical formula is:

R represents: CN or other functional groups.

Acrylic fiber is a synthetic fiber made from copolymers with acrylonitrile as the primary monomer. At least 85% (by mass fraction) of its molecular chain consists of acrylonitrile repeating units. It typically appears white (though it can be dyed other colors), has a curly and fluffy texture, feels soft to the touch, and closely resembles wool, earning it the nickname "synthetic wool." This product falls under the following classifications in the "Customs Import and Export Tariff of the People's Republic of China": 55013000, 55033000, 55063000.

Acrylic fiber is typically spun into yarn via cotton or wool spinning processes and is predominantly used in clothing (such as hats, gloves, scarves, faux fur, sweaters, and knitted sportswear), home décor (such as carpets and curtains), blankets, plush toys, and outdoor applications (such as vehicle and boat covers).

I. Standardized Requirements for Import Declarations

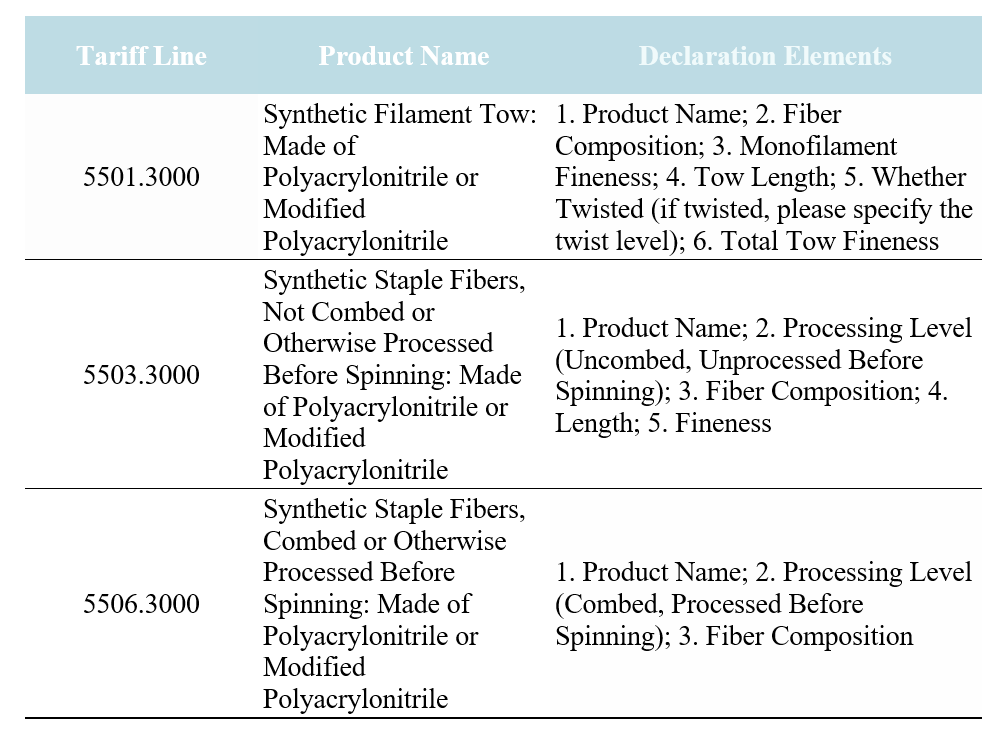

According to the requirements of the Catalogue for Declaration of Customs Import and Export Commodities Tax-Related Regulations of the People's Republic of China (2025 Edition), when declaring commodities under Tariff Nos. 5501.3000, 5503.3000, and 5506.3000, enterprises must provide details such as "product name," "fiber composition," "fineness," "length," "whether twisted," and "degree of processing."

In accordance with the provisions on completing commodity names, specifications, and models in the Specifications for Filling out Customs Declaration Documents for Import and Export Goods of the People's Republic of China (Annex to GACC Announcement No. 18 [2019]), if the consignee of imported goods declares goods subject to anti-dumping and countervailing measures, they must report essential tax-related information, including the "original manufacturer's Chinese name," "original manufacturer's English name," "anti-dumping duty rate," "countervailing duty rate," and "whether the price commitment is met." The format requirement is: "|<><><><><>."

Declaration Requirement I: Symbols

"|" is a separator that is either automatically generated by the system or manually entered after the last declaration element in the specification and model field. If there are no standardized declaration requirements for the relevant commodity tariff number, "|" must be entered manually.

Declaration Requirement II: Symbols <><>

The first two sets of text enclosed in "<>" following the "|" represent the "Original Manufacturer's Chinese Name" and the "Original Manufacturer's English Name," respectively.

Note: In the absence of an original manufacturer’s English name, the name written in the language of the country or region where the manufacturer is located may be provided. For reference on the foreign name format, see the relevant announcements issued by the Ministry of Commerce regarding trade relief measures.

Declaration Requirement III: Symbols <><><>

The last three sets of text enclosed in "<>" correspond to the "Anti-Dumping Duty Rate," "Countervailing Duty Rate," and "Whether the Price Undertaking is Met."

For the "Anti-Dumping Duty Rate" and "Countervailing Duty Rate," enter the actual values. For example, if the tax rate is 30%, input "0.3."

For "whether it meets the price commitment," enter "1" for "yes" or "0" for "no."

When filling out the form, all five "<>" fields are mandatory. If there are no items to declare in fields 3, 4, and 5, the content within the corresponding "<>" can be left blank, but the "<>" placeholders must still be retained.

II. Classification Declaration of Import Declaration

According to the Announcement of the General Administration of Customs of China (GACC) on the Declaration Requirements for Commodity Codes Related to Acrylic Fiber (Announcement No. 59 [2022] of GACC), the requirements for declaring relevant commodity codes are as follows:

1. When the consignee of imported goods or their agent declares the import of acrylic fiber (tariff line 55013000), the commodity code for polyacrylonitrile filament tow (excluding modified polyacrylonitrile filament tow and polyacrylonitrile-based carbon fiber precursor) should be reported as 55013000.10, while modified polyacrylonitrile filament tow and polyacrylonitrile-based carbon fiber precursor should be reported as 55013000.90.

2. When the consignee of imported goods or their agent declares the import of acrylic fiber (tariff line 55033000), the commodity code for polyacrylonitrile staple fibers that are neither carded nor otherwise processed for spinning (excluding those made from modacrylic) should be reported as 55033000.10, while the commodity code for modacrylic staple fibers that are neither carded nor otherwise processed for spinning should be reported as 55033000.90.

3. When declaring the import of acrylic fiber (tariff line 55063000), the consignee of imported goods or their agent should report the commodity code for polyacrylonitrile staple fibers that have been carded or otherwise processed for spinning (excluding those made from modacrylic) as 55063000.10, and the commodity code for modacrylic staple fibers that have been carded or otherwise processed for spinning as 55063000.90.

Disclaimer:The above content is translated from Chinese version of Tianjin Customs 12360. The Tianjin Customs 12360 version shall prevail.