How familiar are you with the customs duty regulations on items brought into China?

Issue Date:2025-01-06

Proactively Fulfill Tax Obligations According to Law and Enjoy Unhindered Customs Clearance

Since the Measures for the Collection of Customs Duties, Value-added Tax and Consumption Tax on Entry Articles officially came into effect on December 1, 2024, passengers frequently inquire numerous issues when carrying personal belongings into the country: What is the customs tax standard for passengers' luggage and articles? How is the tax calculated? Can common items like cigarettes and alcohol enter the country duty-free? Follow along with us to explore it.

I. Principles for Entry and Exit of Personal Luggage

01 Reasonable self-use principle

Article V of the Customs Duties Law of the People's Republic of China stipulates that customs duties shall be levied on imported articles reasonably used by individuals for their own use in accordance with simplified measures. Imported articles exceeding the reasonable quantity for personal use shall be levied customs duties according to the imported goods.

Reasonableness refers to the fact that it conforms to the situation, travel purpose and residence time of the inbound and outbound personnel or meets the attributes, characteristics, use, value and other factors of the posted articles.

Self-use refers to the use by oneself rather than for sale or lease.

02 Active declaration principle

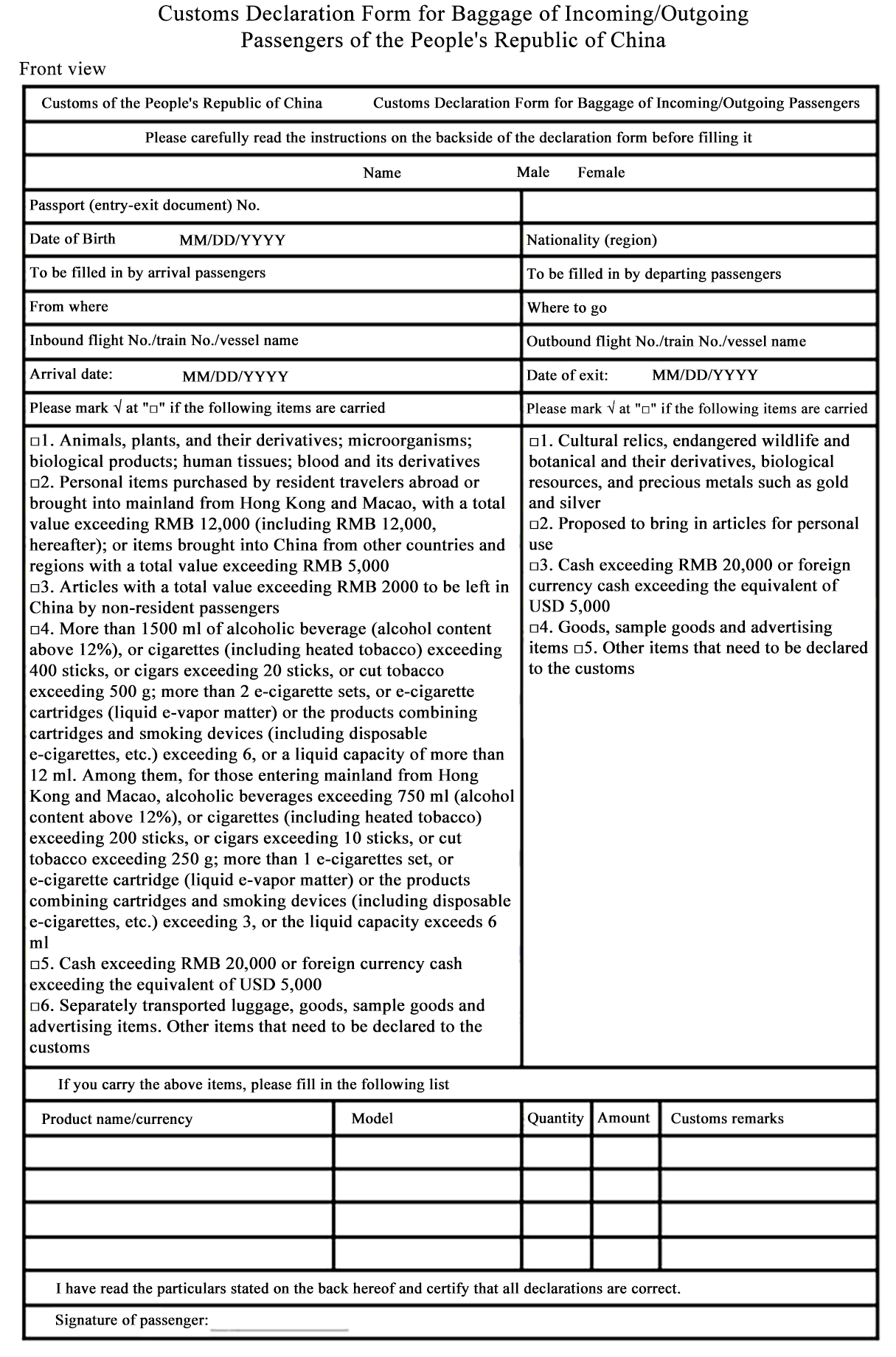

Article 47 of Chapter IV of the Customs Law of the People's Republic of China stipulates that the owner of imported and exported items shall truthfully declare to the Customs and accept inspection by the Customs. Seals affixed by the Customs shall not be opened or broken by any person without authorization.

Tips

Passenger with declaration requirements, please select the following declaration channels to accurately report to customs.

II. Provisions on Taxation of Passenger Luggage

01 Tax exemption limit

According to Announcement No. 11 [2024] of the Tax Commission and Announcement No. 7 [2024] of the Ministry of Finance-the State Administration of Taxation of GACC:

General provisions

For inbound resident travelers carrying luggage and items acquired overseas with a total value of up to 5,000 RMB (inclusive), and for inbound non-resident travelers carrying items intended to remain in the country with a total value of up to 2,000 RMB (inclusive), the customs will grant duty-free clearance. The total value of the luggage and items transported by inbound resident passengers through separate transportation shall be calculated on a consolidated basis, together with such luggage and items that have been examined and released by the Customs at the time of entry.

Special provisions

Resident passengers aged 18 or above entering mainland from Hong Kong and Macao will be exempted from duty if they carry luggage within RMB 12,000 (inclusive) for personal use. Meanwhile, at ports with inbound duty-free shops, the above-mentioned passengers are allowed to purchase a certain number of duty-free goods at the inbound duty-free shops. If the total value of their personal reasonable luggage and articles obtained from abroad is within RMB 15,000 (inclusive), they will be granted duty-free clearance.

02 Disposal of tax

For items of luggage exceeding the above amount, tax shall be levied only on the excess part, but full tax shall be levied on indivisible single articles.

03 Special personnel

For frequent entry-exit personnel and minors under the age of 18, the customs will only release their travel necessities free of duty. For the staff of inbound means of transport, only necessary goods during their service period shall be released by customs duty-free.

Resident passengers refer to those who return to their usual places of settlement in China after staying abroad.

Non-resident passengers refer to those who return to their usual places of residence after entering China for residency.

Frequent entry and exit personnel refer to those who enter the country more than once within fifteen days.

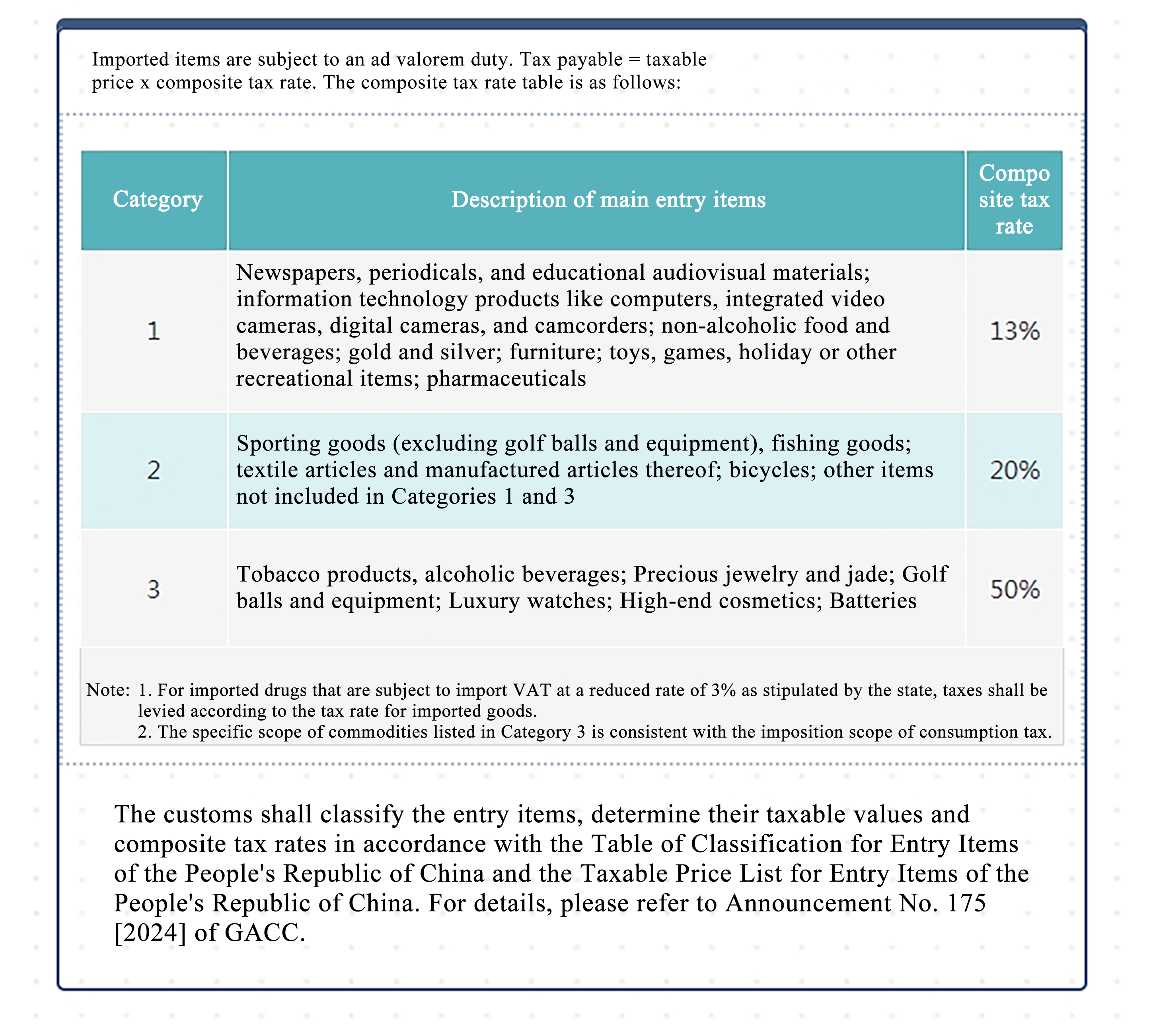

III. Tax Collection

IV. Duty-free Limits of Tobacco and Alcohol

01Tobacco products

Inbound passengers: 400 cigarettes (including heated cigarettes), or 20 cigars, or 500g cut tobacco; 2 e-cigarette sets, and 6 e-cigarettes cartridges (liquid e-vapor matter) or products combining cartridges and smoking devices (including disposable e-cigarettes, etc.), with a total liquid capacity of no more than 12 ml.

Among them, the following items will be imported from Hong Kong SAR and Macao SAR: 200 cigarettes (including heated tobacco), or 10 cigars, or 250g cut tobacco; 1 e-cigarette set, 3 e-cigarettes cartridges (liquid e-vapor matter) or products combining cartridges and smoking devices (including disposable e-cigarettes, etc.), with a total liquid capacity of no more than 6 ml.

Frequent entry-exit personnel: 40 cigarettes (including heated cigarettes), or 2 cigars, or 40 g of cut tobacco; 1 e-cigarette set, and 1 e-cigarettes cartridge (liquid e-vapor matter) or product combining cartridges and smoking devices (including disposable e-cigarettes, etc.), with a total liquid capacity of no more than 2 ml; only once a day.

02 Alcoholic beverages

Inbound passengers: 1.5 liters of alcoholic beverages above 12% ABV. Among them, 0.75 liters of alcoholic beverages above 12% ABV are for passengers arriving from Hong Kong SAR and Macao SAR.

Frequent entry-exit personnel: Alcoholic beverages above 12% ABV are not allowed to be brought into China tax-free.

Reminder: The total value of inbound tobacco and alcohol brought by passengers duty-free is included in the tax exemption quota for luggage.

V. Customs Tips

1. Re-entry luggage and articles approved by the Customs shall be released tax-free by the Customs, which shall not be included in the amount of tax exemption.

2. Inbound articles exceeding the reasonable quantity for personal use shall be taxed as goods.

3. Taxable automobiles, motorcycles and their accessories for personal use shall be taxed as imported goods.

Tips: In order to ensure smooth customs clearance, please truthfully and accurately declare the information of dutiable goods to the Customs and provide shopping vouchers for real transactions.

Disclaimer:The above content is translated from Chinese version of this website. The Chinese version shall prevail.