Get to Know Customs Regulations on Managing Inbound and Outbound Luggage and Articles (I)

Issue Date:2025-05-13 Source:China Inspection and Quarantine Times

To facilitate the customs clearance of inbound and outbound luggage and articles and further enhance the efficiency of customs supervision, GACC has integrated and revised six regulations, including the Administrative Measures of the Customs of the People's Republic of China for the Supervision of Inbound and Outbound Passengers' Luggage and Articles, the Regulations of the Customs of the People's Republic of China on the Administration of Transit Passengers' Luggage and Articles, the Regulations of the Customs of the People's Republic of China on the Administration of Travel-Use Articles for Inbound and Outbound Passengers, the Regulations of the Customs of the People's Republic of China on the Clearance of Inbound and Outbound Passengers, the Regulations of the Customs of the People's Republic of China on the Administration of Inbound and Outbound Luggage and Articles for Chinese Nationals, and the Administrative Measures for the Quarantine of Articles Carried by Inbound and Outbound Personnel. GACC issued the Measures of the People's Republic of China for the Customs Supervision of Inbound and Outbound Luggage and Articles in February 2025, issued as Order No. 276 (hereinafter referred to as the "Supervision Measures"), which comes into effect on April 1, 2025.

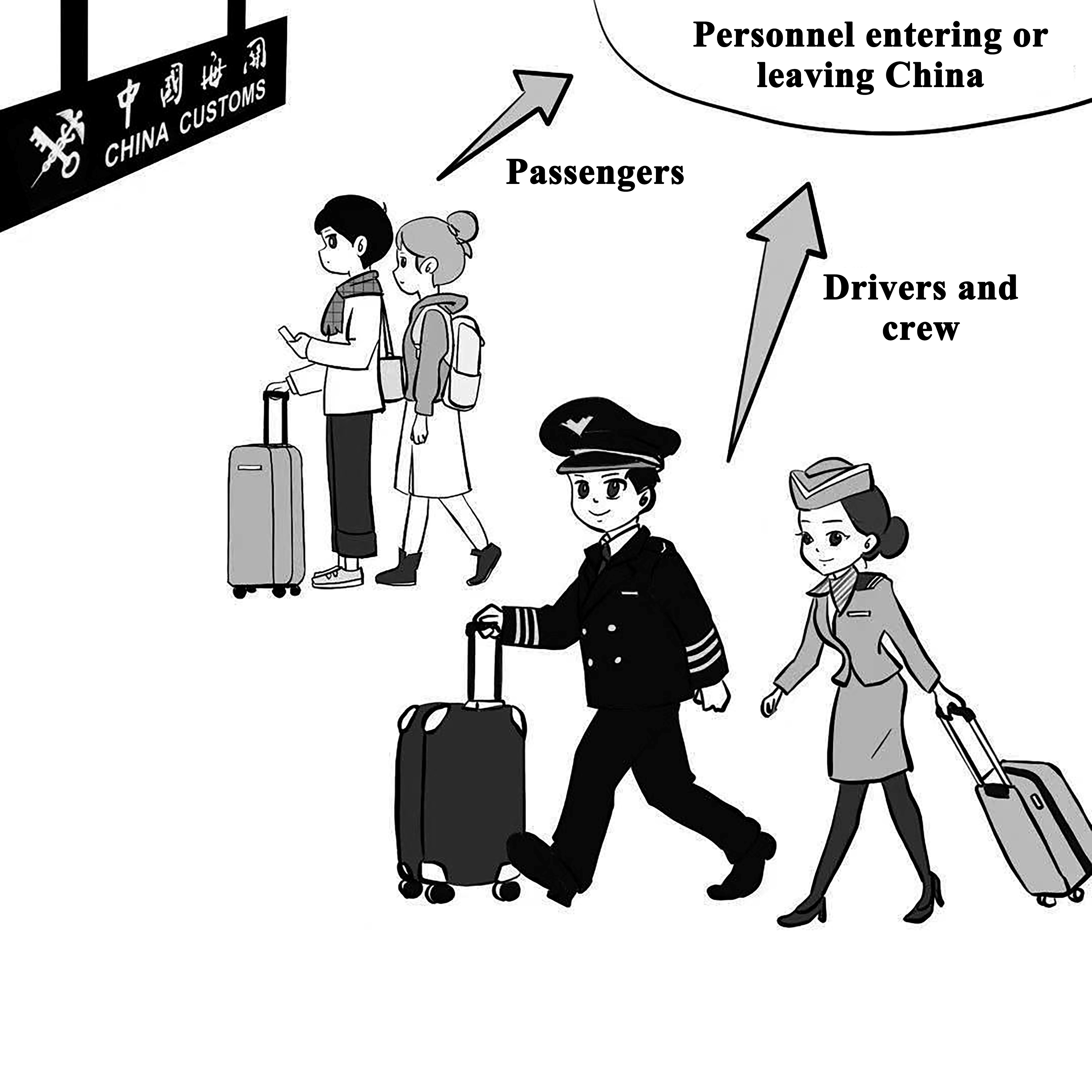

I. Passengers, Drivers and Crew Must Comply

According to Article 4 of the Supervision Measures, personnel entering or leaving China may go through the customs procedures for bringing his or her luggage and articles into or out of the country in person or by agent.

II. Split Tasks for Joint Supervision

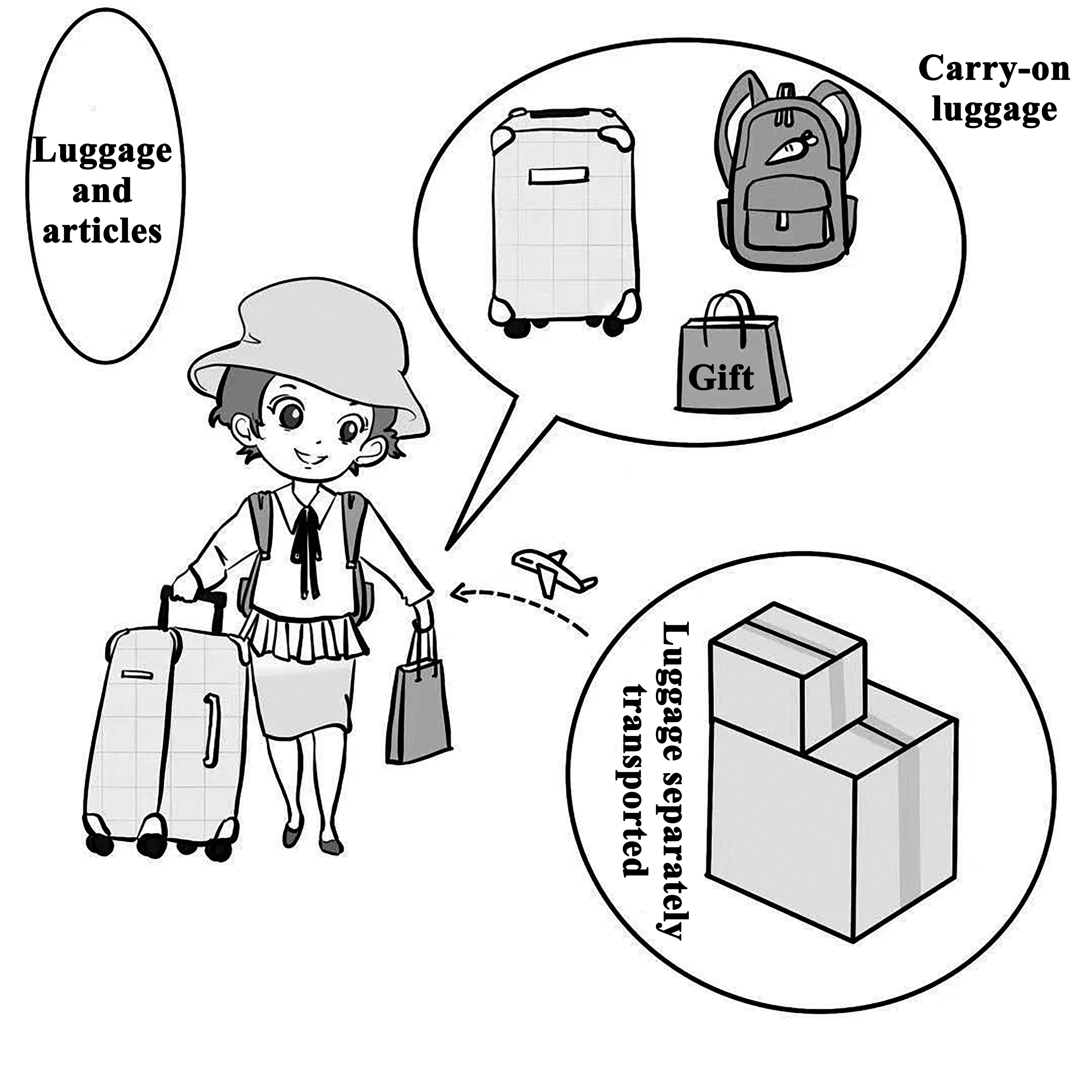

Article 35 of the Supervision Measures defines specific terms as follows:

The term "Luggage and articles" refers to articles carried by personnel entering or leaving China, including both carry-on and separately transported articles.

Article 28 of the Supervision Measures

Personnel entering China with luggage and articles separately transported shall declare them to customs upon arrival. With customs approval, all customs procedures shall be finalized within six months from the personnel's entry date.

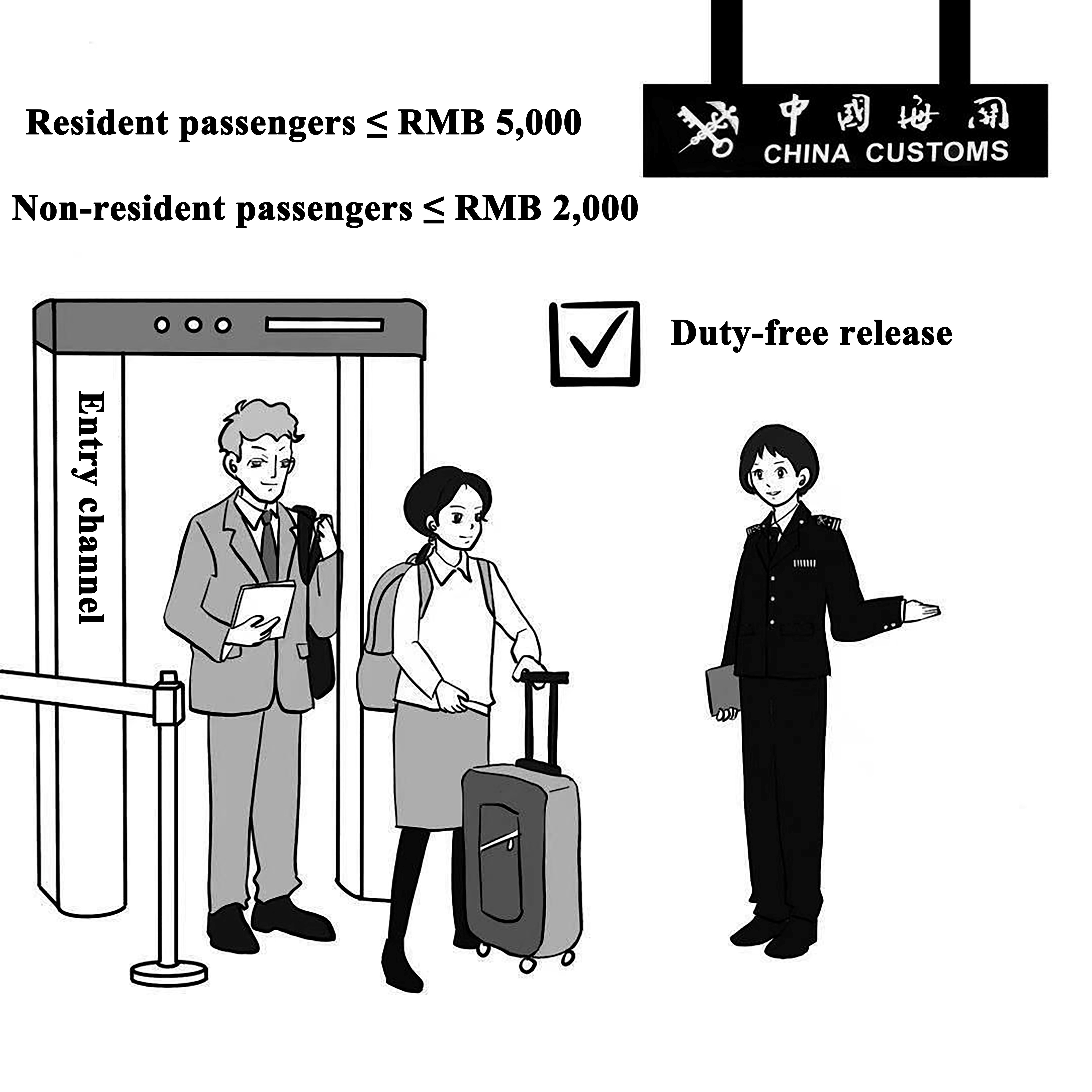

III. Stick to Duty-Free Quotas, Avoid Overindulgence

Article 19 of the Supervision Measures

According to the Tariff Law of the People's Republic of China, the Measures for the Collection of Tariffs, Value-Added Tax and Consumption Tax on Personal Imports, as well as other relevant laws and administrative regulations, customs authorities levy taxes on luggage and articles permitted into the country.

Article 11 of the Measures for the Collection of Tariffs, Value-Added Tax and Consumption Tax on Personal Imports stipulates the following:

For inbound resident passengers carrying luggage and articles acquired overseas with a total value of up to RMB 5,000 (inclusive), and for inbound non-resident passengers carrying items intended to remain in the country with a total value of up to RMB 2,000 (inclusive), the customs will grant duty-free release.

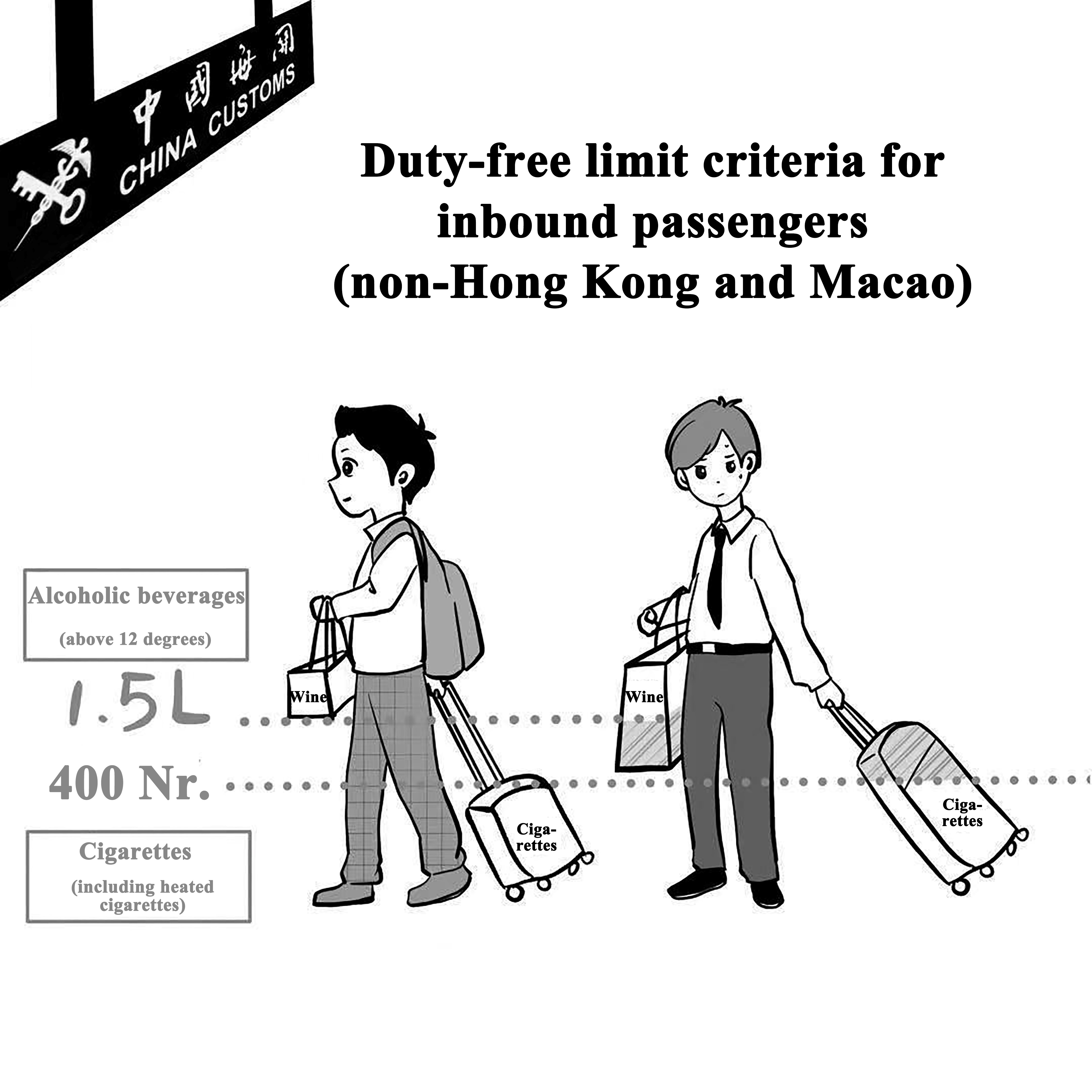

IV. Cigarettes and Wine Duty-Free Limits Apply

Chart of Duty-free Allowance Limits for Inbound Luggage and Articles

Tobacco products: Inbound passengers are allowed to carry up to 400 cigarettes (including heated cigarettes), or 20 cigars, or 500 grams of tobacco... Specifically, passengers entering from the Hong Kong SAR or Macao SAR are allowed to carry up to 200 cigarettes (including heated cigarettes), 10 cigars, or 250 grams of tobacco...

Alcoholic beverages: Inbound passengers are allowed to carry 1.5 liters of alcoholic beverages above 12% ABV. Among them, 0.75 liters of alcoholic beverages above 12% ABV are for passengers arriving from Hong Kong SAR and Macao SAR.

V. Remember Reasonable Self-use Rules

Article 5 of the Supervision Measures

Inbound and outbound luggage and articles must comply with the standards for reasonable self-use. For quantities exceeding these limits, customs processing will follow procedures applicable to goods.

(Author Affiliation: Fuzhou Customs)

Disclaimer:The above content is translated from Chinese version of China Inspection and Quarantine Times. The China Inspection and Quarantine Times version shall prevail.