Skiing, a comprehensive aerobic activity, is not only a vital part of China’s sports industry but has also emerged as a popular recreational pursuit. In recent years, with the continued promotion and adoption of winter sports, consumer demand for snow sports gear has been growing. Among these products, ski boots - as essential gear - have seen increasing import and export activity. This guide explains how to declare ski boots in compliance with Customs regulations.

I. Introduction to Ski Boots

Ski boots are specialized footwear designed for skiing. They feature soles or specific areas with dedicated structures that securely fasten to ski bindings, providing skiers with power transmission, posture control, foot protection, and thermal insulation. They are a type of technical sports footwear.

(I) Categories of Ski Boots

Ski boots are subdivided into cross-country ski boots and snowboard boots; each designed for different types of equipment such as snowboard and skiing scenarios.

1. Cross-Country Ski Boots

Usually made of nylon and leather, these boots have a low cuff and a relatively soft, lightweight construction that allows flexible ankle movement. The forefoot includes a special structure for binding to skis, and the heel can be lifted to facilitate turning and striding motions. They are suitable for cross-country skiing on flat or undulating snow terrain.

2. Snowboard Boots

Snowboard boots generally consist of an inner and outer layer: the outer shell is typically made of rigid plastic, while the inner liner is composed of synthetic fabrics and insulating materials. The boot shaft is high and stiff, providing sturdy support. The boot is fully secured to the ski via bindings, restricting excessive ankle movement to ensure stability and efficient power transfer. They are commonly used in slope style, half-pipe, and other alpine skiing environments.

II. Regulatory Declaration of Ski Boots

(I) HS Codes and Customs Duty Rates

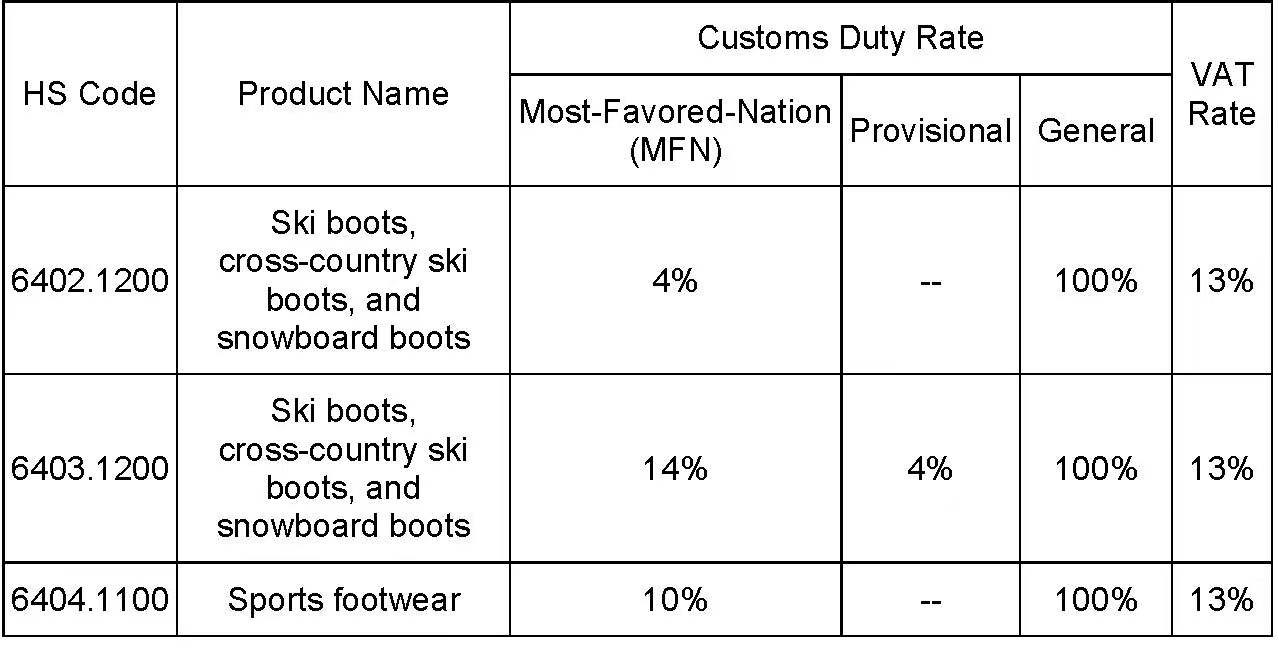

2025 HS codes and corresponding customs duty rates for ski boots

(II) Regulatory Declaration Elements

In accordance with the Directory of Tax-Related Declarations for Imported and Exported Goods of the People’s Republic of China (2025 Edition), enterprises declaring ski boots must specify the following elements:

1. Style: The specific type or model of the footwear.

2. Upper Material: The material used for the upper, defined as the part of the boot above the sole. If the boundary between the outsole and upper is unclear, the upper includes the portion covering the sides and instep. For example, the upper material can be “rubber,” “plastic”, etc.

3. Outsole Material: The material of the outsole, i.e., the part that comes into contact with the ground during use (excluding attached heels). The predominant material in contact with the ground determines the classification of the sole material, regardless of attached reinforcements or accessories under the sole. For example, the outsole material can be “rubber,” “plastic”, etc.

4. Brand (in Chinese or foreign language): The brand name applied by the manufacturer or distributor. The actual brand name in either Chinese or foreign language must be declared.

5. Article Number: A unique identifier assigned by the manufacturer to each style and batch of goods, with each unique combination of style and batch corresponding to a distinct article number.

III. Key Declaration Considerations

(I) Classification Notes

Ski boots should be classified under HS codes 6402.1200, 6403.1200, or 6404.1100 based on their material composition. Among these, 6402.1200 and 6403.1200 are specifically designated for ski boots, whereas 6404.1100 also includes other types of athletic footwear. Importers should confirm whether the goods qualify as used footwear under Heading 63.09 and should distinguish ski boots from ice skates, snow skis, and other skiing equipment classified under Chapter 95 of the Import and Export Tariff of the People's Republic of China (2025 Edition).

(II) Pricing Considerations

1. Undeclared royalty payments.

2. Influence of special relationships on transaction value.

3. Undervaluation in parallel imports.

(III) Origin Considerations

Application of Preferential Customs Duty Rate

Major producing and consuming countries for ski boots include China and Vietnam. Goods of Chinese origin are subject to Most-Favored-Nation or provisional Customs duty rate, while products originating in Vietnam may be eligible for preferential duty rate under the China-ASEAN Free Trade Agreement.

1. For certificates of origin that are electronically linked to Customs data, the primary focus is whether goods applying for preferential treatment meet the rules of origin under the agreement.

2. For certificates of origin not yet electronically linked, attention should be paid to the following:

(1) Consistency of the format, seals, and signatures of both original and re-issued certificates of origin with registered records, and whether such certificates are within their validity period and submitted within the time limit for presentation;

(2) Whether they have been completed correctly in accordance with the instructions on the reverse side of such certificates;

(3) Whether the product descriptions and HS codes are consistent;

(4) Whether the quantity of goods imported claiming preferential duty rate falls within the quantity specified in the certificates of origin; whether the units of quantity on the Customs declaration correspond to those on the certificates of origin; and whether the information and data across all documents such as the commercial contract, invoice, packing list, bill of lading, and certificates of origin are logically consistent and mutually corroborating (e.g., the issuance date of the certificates versus the date of shipment on the transport document, shipping routes, etc.).