How to Handle Classification Dilemmas?

Issue Date:2025-01-14

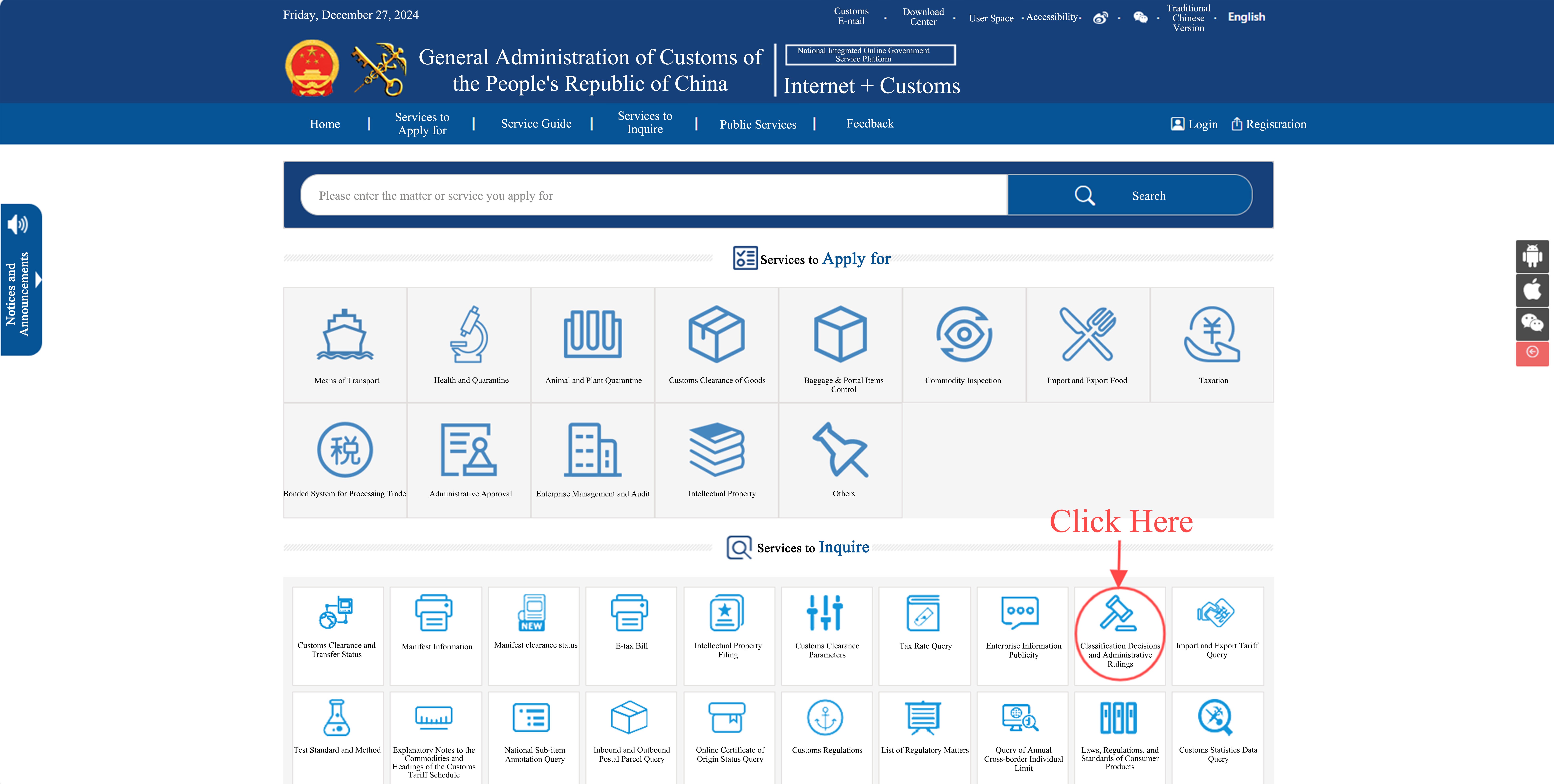

I. Classification Inquiry

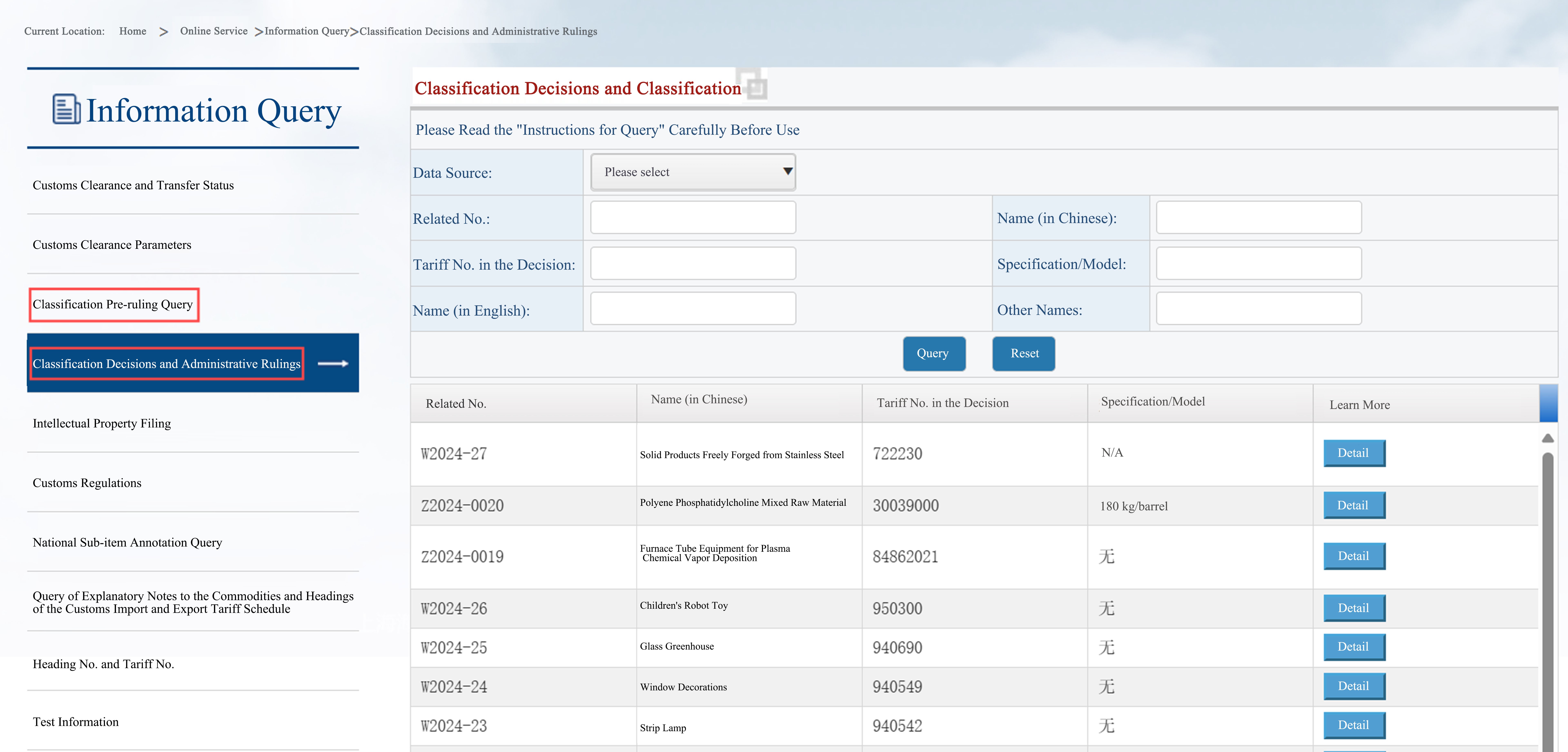

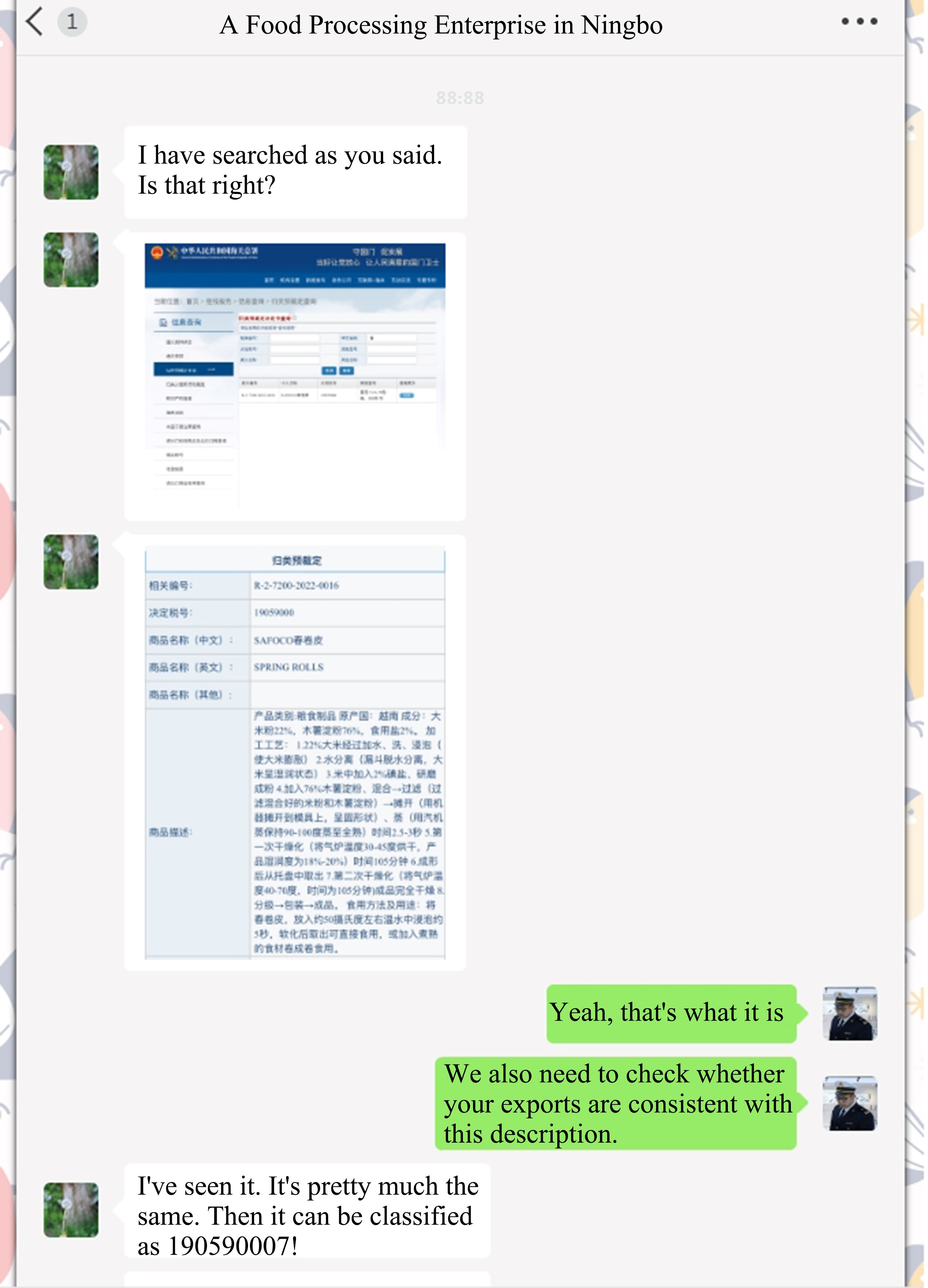

First, visit the official website of GACC at http://www.customs.gov.cn. In the "Internet + Customs" section, locate the "Classification Decisions and Administrative Rulings" subsection and click to enter. In the appropriate dialog box, enter the product you wish to inquire about. If this product is identical or similar to yours, you can adopt the same classification.

If you fail tofind it, locate the "Classification Pre-ruling Query" module on the left side of the interface. Similar to the previous step, enter the product you want to inquire about for search and comparison.

II. Classification Pre-ruling

If you cannot find the appropriate classification in both "Classification Decisions and Administrative Rulings" and "Classification Pre-ruling Query", and you wish to accurately determine the commodity classification, it is necessary to request a customs classification pre-ruling.

Customs classification pre-ruling refers to the process where, prior to the actual import or export of goods, the consignee or consignor of the goods submits an application to the customs in the format specified by the customs authorities, along with relevant documentation. The customs then make a pre-ruling decision on classification based on relevant regulations and issue a Decision on Pre-ruling of the Customs of the People's Republic of China (Commodity Classification).

So, how do you apply for a customs classification pre-ruling, and what are the points for attention?

Steps and points for attention for applying for customs classification pre-ruling:

1. Conditions for Applying for Classification Pre-ruling and Making a Decision

Applicant: The applicant shall be the consignee of import goods or the consignor of export goods.

Application Time: The application for pre-ruling shall be submitted three months before the intended import or export of the goods. Under special circumstances, with legitimate reasons, the applicant may apply for pre-ruling within 3 months before the goods are imported or exported.

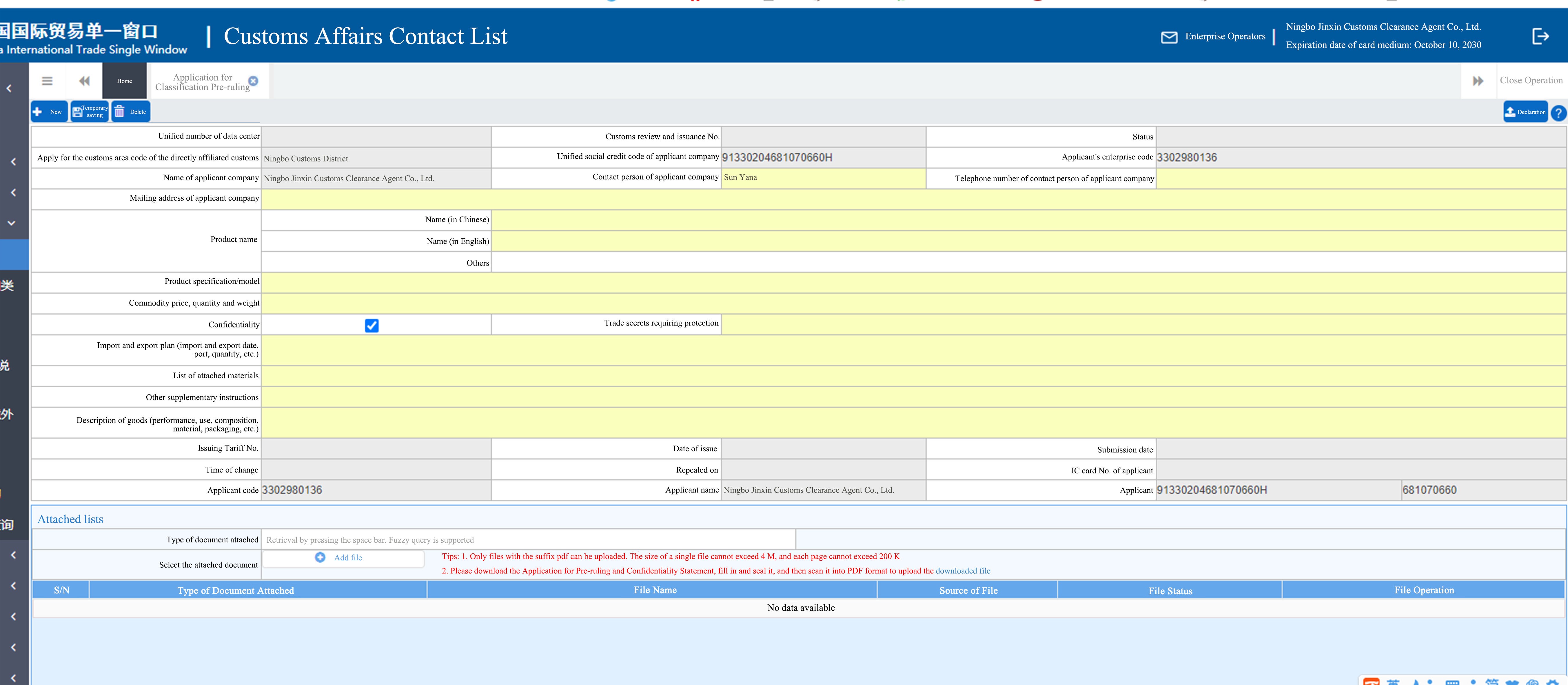

2. Application Preparation

(1) Application for Pre-ruling of Customs of the People's Republic of China;

(2) Import and Export Orders (contracts) or Letters of Intent;

(3) Confidentiality Statement;

(4) Provide relevant materials related to the imported and exported goods.

If the materials are in a foreign language, the applicant shall concurrently submit the Chinese translations that satisfy the requirements of the Customs.

Tips: Commodity information should accurately and comprehensively reflect attributes such as specifications, models, structural principles, performance indicators, functions, uses, compositions, and processing methods.

3. Application Process

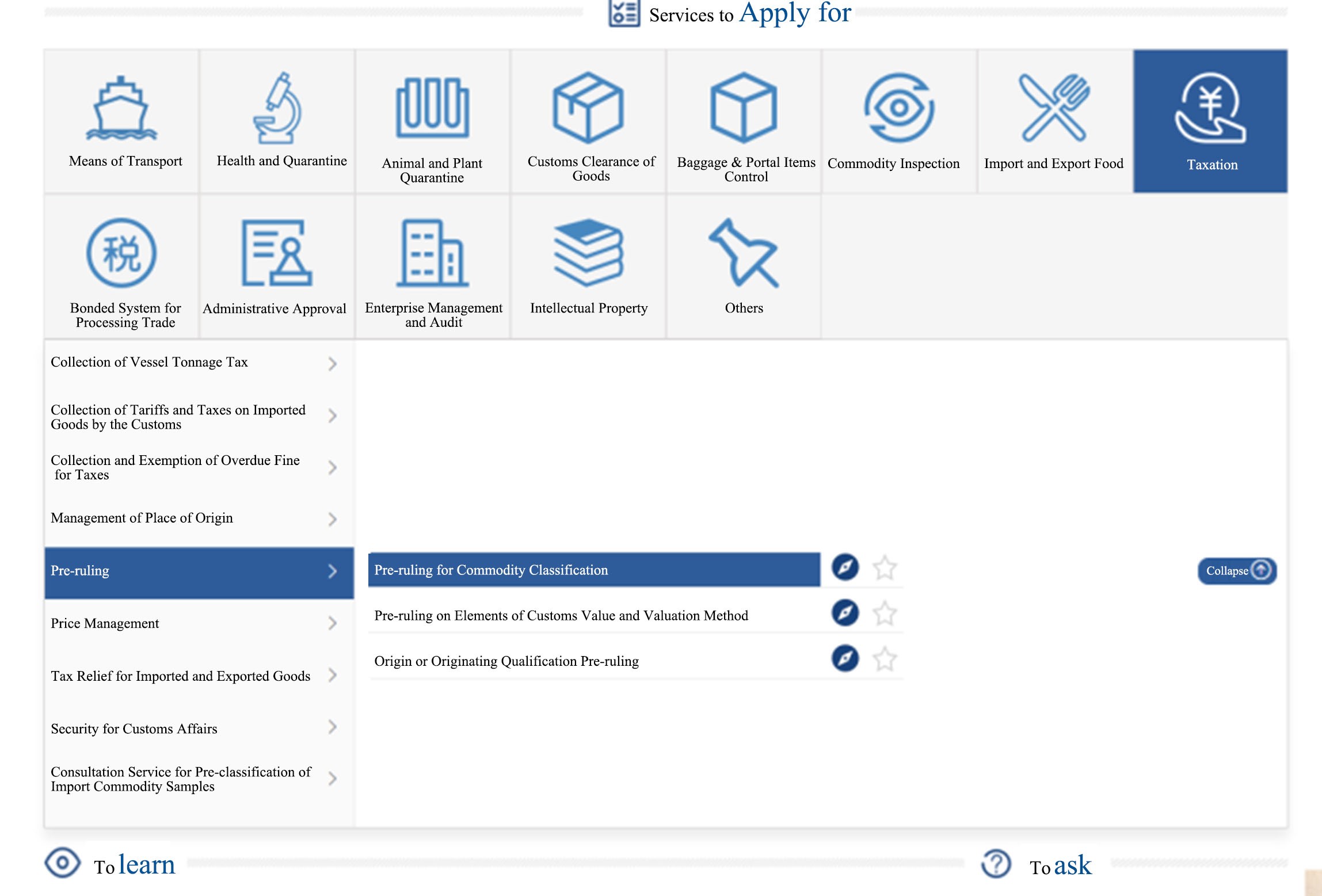

Method I: Applicants can log in to the "Internet + Customs" Integrated Online Service Platform (website: http://online.customs.gov.cn), select the relevant module under the "Tax Business - Pre-ruling - Commodity Classification Pre-ruling" section, and submit an application for classification pre-ruling.

Method II: Applicants can access the business application (standard version) through the China International Trade Single Window (website: http://www.singlewindow.cn/), select the relevant module under the "Customs Affairs Contact Form" section in "Goods Declaration", and apply classification pre-ruling.

4. Customs Processing Time Limit

Within 10 days of receiving the "Application for Pre-ruling" and related materials, customs will review and decide whether to accept the application. If accepted, a "Decision on Pre-ruling" will be issued within 60 days. If additional time is required for testing, inspection, appraisal, expert consultation, or other means to determine the relevant circumstances, that time will not be counted towards this time limit.

5. Validity Period for Classification Pre-ruling

The pre-ruling decision is valid for three years from the date the "Decision on Pre-ruling" is issued. If there are changes to the laws, administrative regulations, customs regulations, or relevant provisions of announcements by GACC that affect the validity of the pre-ruling decision, the decision will automatically become invalid.

Note: Part of this article is based on the Interim Measures of the Customs of the People's Republic of China for the Administration of Pre-ruling.

Disclaimer:The above content is translated from Chinese version of this website. The Chinese version shall prevail.